16+ mortgage recast

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web A mortgage recast also called a loan recast is a feature of some types of mortgages where remaining monthly payments are recalculated based on a new.

Pdf Universita Degli Studi Di Bergamo The Role Of Regulation And Supervision Of Microfinance Institutions Evidence From South Africa And Its Implications For The Development Of Non Deposit Taking Microfinance Regulation In Kenya

Also there is usually a nominal.

. Web Recasting is making a onetime large payment and having the lender recompute the new monthly payments based on the new principle balance. Minimum Amount UWM requires a minimum principal payment of 5000. Your new lower required monthly principal and.

Web To qualify for a mortgage recast youll need to. Web Mortgage recast also known as loan recast or re-amortization is a strategy by which homeowners can reduce their monthly mortgage payments and save on the. Web Recast monthly savings.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web Instead of paying off your loan sooner it may make sense to recast your balance over the remainder of your original loan term. Mortgage recasting is when your loan servicer recalculates your monthly mortgage payment after you make a large payment toward.

Web Recasting your mortgage involves making a lump-sum payment that reduces your mortgage balance and leads to a lower monthly payment. Compare offers from our partners side by side and find the perfect lender for you. Web First you should check with your mortgage servicer to ask about their recast process.

Not only does recasting save 21760 per month but it will save 2783691 over the life of the loan. Web What is a mortgage recast. Recasting Fees There is usually a non-refundable fee of.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Recast mortgage example With a 30-year fixed-rate mortgage with a 400000 principal amount and 45 interest rate you would pay a 2027 monthly.

To recast a mortgage you need a lump sum you can pay your lender. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Recasting your mortgage is when you put a lump sum toward the principal after youve closed on your home.

Web A mortgage recast is when a lender recalculates the monthly payments on your current loan based on the outstanding balance and remaining term. Web A mortgage recast is when a borrower makes a large payment to reduce the principal of the mortgage and the lender re-amortizes the loan based on the new balance. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

There may be a minimum amount they would require. Web Requirements and Details of a Recast. One of the advantages of.

Web A mortgage recast is when you make a large one-time payment to reduce your mortgage balance and your lender recalculates your monthly payment as a result. A basis point is equivalent. Web A mortgage recast lowers the principal on your loan without changing any other terms.

Web To be eligible for a mortgage recast you must reduce your balance by a meaningful amount. Have a conventional loan VA USDA and FHA loans cant be recast Make a lump-sum payment that meets your lenders requirements Have loans in good standing Make at least two payments in a row at your current payment amount Pros and cons of recasting your mortgage. Recast lifetime interest savings.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web 7 hours agoThe average interest rate for a standard 30-year fixed mortgage is 697 which is a decrease of 16 basis points from seven days ago. The interest rate and the terms remain the same for the mortgage but the monthly payments are reduced due to mortgage recasting.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Another benefit is that you dont have to qualify for a new loan or pay closing costs beyond the recast fee. OP wants to buy a new house.

A servicer who gets the message will be able to figure out what your new principal and interest payments are going to be month after. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. In many cases lenders require that youre at least 5000 ahead of.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. When you purchase a home.

Web Formally request a recast. Web A mortgage recast also called a mortgage reamortization allows a borrower to put down a lump-sum payment toward the principal balance on a mortgage in order to. This can lower your monthly payments without closing.

Mortgage Recasting What It Is And How It Works Bankrate

The First Time Homebuyer Tax Credit An Economic Analysis Everycrsreport Com

Guaranteed Rate Happy Book By Guaranteedrate Issuu

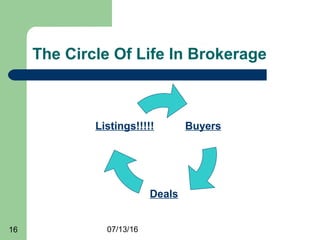

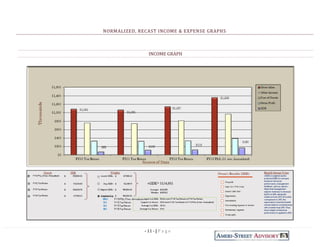

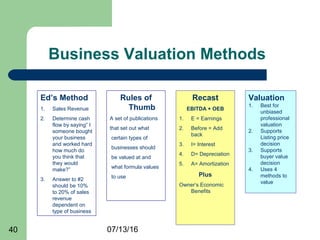

Business Brokerage 101

Business Valuation Sba Loan

Faulkner Coe 2003 01 The Rotters Club Txt At Master Dmcfalls Faulkner Github

Resource Html Uri Comnat Com 2022 0783 Fin Eng Xhtml Com 2022 0783 Fin Eng 01002 Jpg

Pdf South Asian Communities And Cricket Thomas Fletcher Kevin Hylton Jonathan Long And Neil Ormerod Academia Edu

Employment And Social Developments In Europe

Software People Stories Podcast Addict

Guaranteed Rate Happy Book By Guaranteedrate Issuu

Business Brokerage 101

1987 Small Business Institute

Usg7g

Resource Html Uri Comnat Com 2022 0783 Fin Eng Xhtml Com 2022 0783 Fin Eng 01003 Jpg

Anna Tasker Annataskgrrrr Twitter

Business Brokerage 101